In 2015, the tonnes of fresh products which have been transported in Spain have increased by 6.22%

In 2015, the tonnes of fresh products which have been transported in Spain have increased by 6.22%

Coinciding with the start of the fruit and vegetable campaign in the main producing countries in Europe, where Spain and Italy play an important role, it is time to analyse the importance which refrigerated transport seems to have recovered during this year.

As we read in the Refrigerated Transport Special which cadenadesuministro.es published in September, we are amidst a “moment of economic expansion” in which frigo transport is experiencing a certain degree of growth: “the Spanish refrigerated transport sector has been favoured by an increase in imports and exports”. In Europe there is a growing trend for importing fruit and vegetables, meat and fish from countries in the south, a fact which in 2015 has led to a 6.22% increase in the transported tonnes in comparison to 2014.

Is this growing trend reflected in the Wtransnet Freight Exchange?

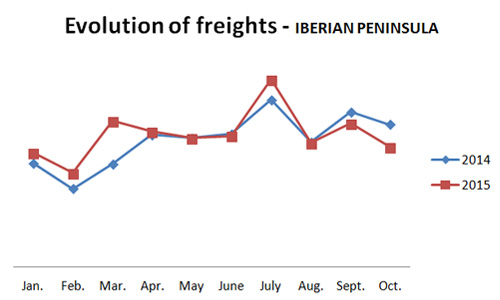

Due to its leading role in Southern Europe, which brings together the main fresh produce producers in the continent (Spain, Italy and France), Wtransnet has always been the perceived as the ideal solution for procuring refrigerated transport. Hence, it is no surprise that the growth figures shown by the freight exchange for refrigerated transport, with a 3.5% growth compared to 2014 – for loads originating in the Iberian Peninsula and destined for Europe, are in line with the increase in exports.

Also highlighting the growth in the Italian refrigerated market, of similar characteristics to the Spanish market and where fresh produce exports represent the gross of its economy. With regards to 2014, the year in which Wtransnet increased its presence in Italy, the growth in refrigerated loads exported towards Europe has increased by 6%.

As read in the special publication by cadenadesuministro.es, imports have also increased: “In the first half of 2015, fresh fruit and vegetable imports have reached 949 million Euros, a 12.45% growth compared to the same period in 2014”.

This has also been reflected in the freight exchange to a greater extent than in exports, seeing a 6.16% increase in refrigerated loads imported from Europe towards the mainland Spain and an 8.93% increase when referring to loads destined to Italy.

How does this growth affect transport companies?

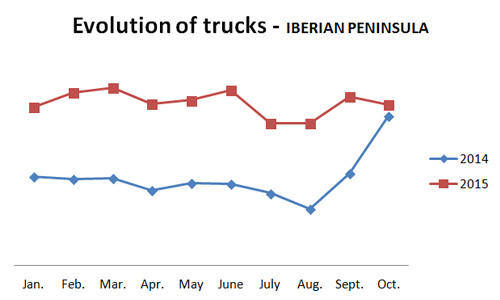

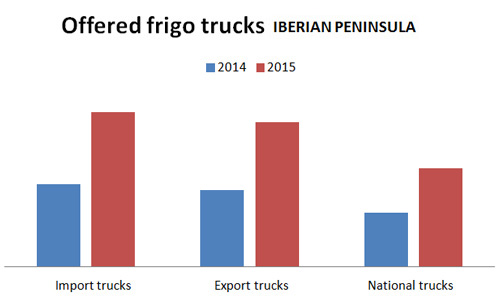

This is possible the most significant figure for us and the one from which we can extract the most conclusions. As we read in Logística y Transporte, during the first two months of the year, we have seen record sales for refrigerated semi-trailers in Spain, with 68% more number plates issued that in the same period in 2014. This has led to an 85% increase in the offers for refrigerated lorries within the freight exchange for an ever more demanded transport.

This growth in the offer of refrigerated vehicles has been reflected with the same values either exclusively for the national market, as well as for the export and import market, with Wtransnet becoming an ideal option for procuring this type of goods transport due to the large volume of specialist refrigerated transports.

In line with the parallelism with the Italian market, where the average growth in lorries is quite similar to that in Spain, with an 81% increase in offer with regards to the previous year, it is worth highlighting the breathtaking 139% increase in vehicles available for exporting from Italy to the rest of Europe.

Another figure to take into account takes us back to the last edition of WConnecta, the International Meeting of Transport Professionals, promoted by Wtransnet Foundation, which was held in Madrid on 30 October. At WConnecta, where a significant part of the activity is carried out via speed networking, only in the refrigerated speciality, a total of 1,944 fast interviews (23% of the total) between companies interested in finding collaborators, either with loads or with refrigerated lorries, in mainland Spain and Europe in general.

English

English Español

Español Deutsch

Deutsch Français

Français Italiano

Italiano Português

Português Polski

Polski Wtransnet Blog Wtransnet Blog: Transport and Logistics News in Europe.

Wtransnet Blog Wtransnet Blog: Transport and Logistics News in Europe.